Can Trump End the Trade War?

The drumbeat of the trade war continues to build momentum.

Much depends on the outcome of this conflict between America and China. The stakes are high.

Both sides are ramping up sanctions and export restrictions. The U.S. has heavily restricted China’s access to AI hardware such as GPUs, and banned export of the equipment necessary to manufacture such tech.

The Biden admin slapped 100% tariffs on Chinese electric vehicles. And President Trump may apply more severe tariffs on other Chinese products.

China is also escalating, having just added 28 U.S. companies, primarily defense contractors, to its sanction list.

This is a new stage in the trade war.

The CCP’s most significant move so far is its December 2024 ban on refined mineral exports to the United States. Particularly gallium.

Let’s explore why this rare metal is so important.

China produces about 98% of the world’s gallium. The mineral is critical for making semiconductors, optoelectronics, weaponry, and much more.

Gallium is used similarly to silicon, but is superior in many ways. It can operate at much higher temperatures and voltages, allowing for smaller, faster, and more efficient chips.

A few products that require gallium include phones, power supplies, LEDs, satellites, 5G networks, missiles, planes, radar, LiDAR, chargers, and electrical equipment. In short, gallium is needed to keep modern-day society running, and in many cases there are no good substitutes.

The U.S. Geological Survey (USGS) did a study back in 2022 exploring what would happen if America’s supply of gallium was disrupted. Its conclusion was shocking:

“…a 30 percent supply disruption of gallium could cause a $602 billion decline in U.S. economic output, or 2.1 percent of [GDP].”

A 2.1% GDP drop from a 30% supply decrease in a single mineral? What happens if there’s a 70% reduction?!

How Did We Get Here?

How did we become so dependent on China for gallium and other critical minerals?

In many ways, China has intentionally built our dependence over time, beginning in the 1980s.

The CCP heavily subsidized and incentivized their rare mineral industry, and made it simple for companies to get mining permits. They also accepted the significant environmental side effects.

The scale and low costs they have achieved since have essentially driven most competitors out of business.

Building new mines and refineries will take time, probably at least 5-10 years. China has also restricted the export of refining and production equipment for these minerals, so that adds an extra wrinkle to the situation.

There are small rare mineral operations in several countries outside China, but not enough to support Western demand for gallium, graphite, and other key materials which China is no longer providing.

If the trade war continues to escalate, inflation could return with a vengeance. We may see another period similar to COVID, when production froze up and prices soared as a result.

Let’s recall that in 2021 used car prices jumped 40-50%. That was primarily the result of temporary supply chain disruptions.

We could see something similar in the near future.

It seems we’re at a bit of an impasse. Somebody needs to make a deal.

Art of the Deal

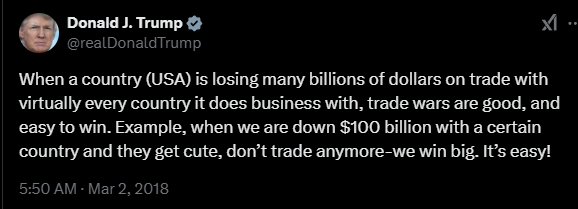

During President Trump’s first term, he described trade wars as “easy to win”. Trump did find success in his first term, raising tariffs on China and having some success with reshoring.

The U.S. is in a strong negotiating position. Between access to AI hardware, and the American market itself, China is equally dependent on us. Approximately 16% of total Chinese exports are to the U.S. today.

But unfortunately, that dependence does go both ways. We need them for materials such as lithium-ion batteries and gallium. At least until we can create our own.

But until America rebuilds its industrial base and establishes alternative sources of key materials, this will continue to be an issue.

When he enters office, I suspect one of Trump’s top priorities will be to strike the best deal he possibly can with China. It’s time to end this trade war, or things could get out of hand.

Sealing a deal may require restoring China’s access to top-end GPUs and semiconductor manufacturing equipment. America’s security state will be reluctant to do so due to the growing importance of AI in military and commercial activities. But it’s one of the key negotiating levers we have.

Once a deal with China is struck, then Trump can focus on building up our domestic industry. And we can begin to work on re-establishing self-reliance.

We’ll keep you updated on this developing story.

Comments: