Here’s Your Next Profitable “Fear Trade”

Hurricane Milton is slicing across the Gulf of Mexico, intensifying into a monstrous Category 5 storm that’s now threatening to lay waste to Florida.

If you’re keeping score at home, this will be the second major storm to make landfall in the US in a matter of weeks. Tampa residents haven’t even finished clearing debris from Helene – and now many are forced to evacuate ahead of Milton’s landfall.

Unfortunately, this potentially disastrous weather event isn’t the only October surprise we’re encountering this week…

Hezbollah showered Haifa in rocket fire early Monday morning. Meanwhile, Israel expanded its operations in southern Lebanon. Every day brings new escalation in the Middle East as the world watches to see just how far the conflict will extend.

The news cycle is getting a little scarier these days, even with the major averages perched within spitting distance of all-time highs. But I still think there’s a decent chance that some additional fear could weigh on stocks over the next several weeks.

So, what’s the ideal fear trade that’s ready to blast higher over the next few weeks?

Energy Stocks: Worst to First

The world runs on oil and gas.

Refined oil products – paraffin oil, white mineral oil, petroleum oil, and other petrochemicals – are found in everyday household products from aspirin to cosmetics. Fertilizers, plastics, rubber, poly–blend workout gear with SPF protection… even your couch cushions are made with polyurethane foam.

Even so-called green tech is completely dependent on the sector. Tesla can’t make a single Robotaxi without crude oil. How do you think they would pull all the copper out of the ground?

But lately, the market hasn’t acted like this sector matters much at all…

If you were searching for gains this past summer, you weren’t finding them in energy stocks.

In fact, energy stocks came in dead last amongst the major sectors in Q3 performance, with the Energy Select Sector ETF (XLE) dropping more than 3% July through September. The sector was even threatening to flip negative on the year just a few weeks ago as many of these stocks continued to unwind from their April highs.

The situation changed just before the calendar flipped to October. XLE has rocketed higher by nearly 10%, closing higher for seven straight trading sessions to reach levels not seen since late May.

Of course, the situation in the Middle East is aiding the dramatic rise in oil and energy names. Goldman Sachs is now warning Brent crude could see $90-plus if Iranian oil comes off the market.

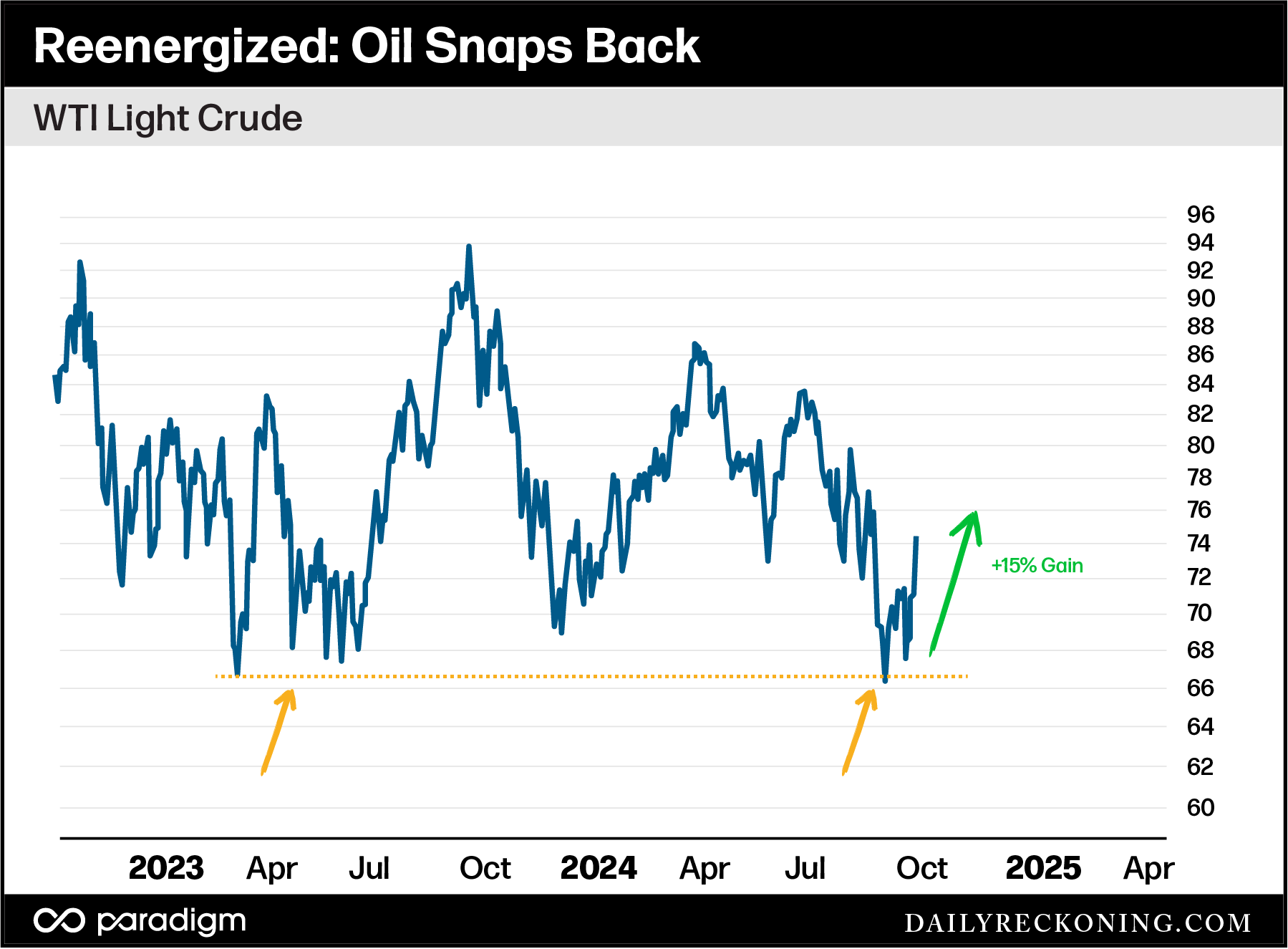

Turning to light crude, we can clearly see the shelf of support going all the way back to early 2023. Buyers have stepped up every time light crude has retreated to the mid-$60 range. And thanks to the fear factor, it has enjoyed a 15% bounce off those lows.

This is an impressive first thrust off the September lows. And it’s just getting started. With the herd just beginning to pile into forgotten energy names, we could see this rally continue – with no shortage of explosive trading options.

If You Want Energy, You Have to Go Out and Buy It…

Energy stocks currently account for a little more than 3% of the S&P 500. The sector’s weighting increased to 15% during past oil spikes over the past several decades – and the average weighting is roughly 10%. We’re obviously nowhere near these levels right now.

If you want oil, you have to get after it. You simply cannot buy an index fund and expect to capture any returns from the energy sector, especially since many of the most prolific “dirty” energy names have been purged from the indexes.

Case in point: XOM.

The Dow booted Exxon Mobil in 2020 shortly after oil futures went negative in the midst of the pandemic crash. At the time, XOM was trading near 15 year lows.

Not anymore! XOM is casually hitting new all-time highs this week. The stock has now climbed more than 300% off its 2020 lows. It also doubled its Permian Basin holdings after acquiring Pioneer Natural Resources for $60 billion last fall.

As more investors notice ExxonMobil’s sly breakout, money will flow upstream to the exploration and production industry. These are the companies pulling the raw material from the earth: Transocean (RIG), Occidental Petroleum (OXY), Diamondback (FANG), and Marathon Oil Corp. (MRO).

There are already explosive rallies underway in these names. Volume is increasing and we’re seeing renewed near-term relative strength amongst the E&Ps.

I like buying strength in this group, as well as grabbing last cycle’s leaders against logical support levels. Marathon Petroleum (MPC), Phillips 66 (PSX), and Valero (VLO) all hit new all-time highs earlier this spring.

We could also see additional mergers and acquisitions in the sector since ESG makes it more attractive for the majors to acquire, rather than develop acreage. The FTC recently approved Chevron’s acquisition of Hess. Diamondback Energy closed its merger with Endeavour Energy Resources last month. Even Midstreams are merging, with Oneok acquiring Magellan Midstream Partners last fall.

A Stickier Rally

We haven’t spilled a ton of ink over the energy sector since the very start of the second quarter. Yes, it was a strong contender for a summer rotation play when crude retook $80 and the big oil and gas companies posted market-leading moves in late June.

But the sector was unable to rekindle the magic from that huge breakout move way back in April. You probably recall how XLE rallied double-digits, only to run into trouble and fizzle out.

It’s different this time around. Once money starts pouring in – combined with a little bit of the fear we’ve been talking about – we’ll know we’re in the thick of a strong energy bull.

Comments: