America’s “Quiet Coup”

Is the United States enduring a “Quiet Coup”? Economist Peter St. Onge:

In the wake of the 2008 Financial Crisis, former chief economist of the IMF Simon Johnson warned that the same dysfunctional policies he saw in his basket-case banana republics had taken hold in the United States.

Johnson warned that if America didn’t act fast, we would plunge into a “Quiet Coup” as the American financial system effectively captures the government, bailing itself out until we run out of money.

The United States did not “act fast.” It did not act whatsoever. The result?

The subversives of the American financial system have seized the commanding heights.

Much of the financial and governmental apparatus is in their grasping hands.

The Triumph of Financialization

As Mr. St. Onge reminds us: Between 1973 and 1985, the United States’ financial sector never exceeded 16% of the domestic corporate product.

Yet by the early 2000s? The United States’ financial sector was spitting out 41% of the domestic corporate product.

Meantime, the United States financial industry represented some 10% of the gross domestic product in 1970.

By 2010 the financial system ballooned to 20% of the gross domestic product… inflated and levitated by the Federal Reserve’s false helium.

The Origins of the Quiet Coup

Here Mr. St. Onge traces the coup’s evolution to the early 2000s:

[America’s financial sector] turned a chunk of [its] profits into lobbying, repealing Depression-era prudential regulations separating banking and investment banking. In other words, freeing banks to gamble with taxpayer-guaranteed funds.

Then it lobbied to raise leverage — meaning how much the financial sector could borrow. So it could make large gambles with a small amount of money — again, all taxpayer-guaranteed.

The end result was the 2008 crisis, where banks made trillions in risky loans to people with no income, no assets and no credit.

The leverage meant they had bet the farm and then some — keeping all the profits. Then when it turned south they sicced lobbyists on Washington to line up bailouts, using the real economy as a hostage to wring out yet more lobbyist favors.

From Cats’ Paws to Giants’ Feet

Yet perhaps the Quiet Coup originated earlier than the early 2000s.

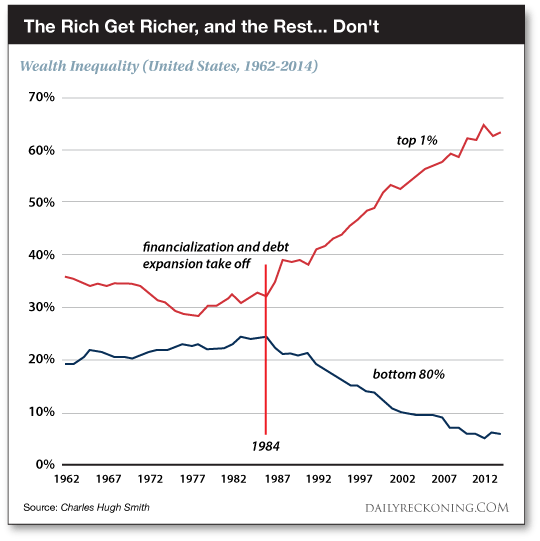

Here is represented, in graphic form, the progress of this Quiet Coup… approaching first on the slinks of cats’ paws… then the stomps of giants’ feet:

The Subversives Pull Ahead

As revealed: The bottom 80% of American earners marched ahead from the early 1940s through the early 1970s.

Revealed also is that the tiptop 1% lost ground to the guttering 80% across the same stretch.

Yet in the early 1980s the tiptop 1% went leaping ahead… and began showing the 80% its dust.

The Quiet Coup was beginning to murmur. Yet the murmurs were ignored.

And so today the Quiet Coup dins.

The subversives are very nearly enthroned if not entirely enthroned.

It is far from clear that the coup is reversible absent highly concerted and determined action.

A Coup Needn’t Be Violent

As far as subversives run, these fellows are a curious bunch.

They wield no daggers, they shed no red blood. No Caesar must beware the Ides of March.

They instead wield dollars and shed red ink.

A successful coup requires a heavily financialized economy with perpetually expanding credit — that is, debt — to keep the show going.

That debt becomes a weapon in the subversives’ hands and a millstone upon society’s neck.

They chokes off savings and investment in productive assets. Speculation goes amok.

Rack and ruin is next.

Now comes a question: Was the Quiet Coup in some sense inevitable?

Is America in a “Signal Crisis”?

A finance man named Johnston — Henry Johnston — stretched the historical canvas upon his work desk.

He concluded:

An examination of history reveals recurrent instances of financialization that bear remarkable similarities, which invites the conclusion that perhaps the predicament in the American economy in recent decades is not unique and that the ever-rising power of Wall Street was in a sense preordained.

Does the Quiet Coup represent a “signal crisis”? Johnston:

This leads to the onset of what [the Italian political economist and historian of global capitalism Giovanni] Arrighi calls a “signal crisis,” meaning an economic crisis that signals the shift from accumulation by material expansion to accumulation by financial expansion. What ensues is a phase characterized by financial intermediation and speculation.

Another way to think about this is that having lost the actual basis for its economic prosperity, a nation turns to finance as the final economic field in which hegemony can be sustained. The phase of financialization is thus characterized by an exaggerated emphasis on financial markets and the finance sector.

This the United States has witnessed.

False Renaissance

More:

The 1970s was a decade of deep crisis for the U.S., with high levels of inflation, a weakening dollar after the 1971 abandonment of gold convertibility and, perhaps most importantly, a loss of competitiveness of U.S. manufacturing.

Then came financialization and its shiny gimcrack:

But financialization also allowed the U.S. to reflate its economic and political power in the world, particularly as the dollar was ensconced as the global reserve currency. This reprieve gave the U.S. the illusion of prosperity of the late 1980s and ’90s, when, as Arrighi says, “There was this idea that the United States had ‘come back.’”

Yet the transformation from productive phase to financialized phase is temporarily and transiently lovely.

It attains — in fact — the appearance of an economic renaissance.

It is mistaken for the triumphant phoenix, rising gloriously from flames.

Financialization Masks the Trajectory of Decline

Again, Mr. Johnston:

The corrosive nature of financialization is not immediately evident — in fact, quite the opposite… The turn to financialization, which is initially quite lucrative, can provide a temporary and illusory respite from the trajectory of decline, thus deferring the onset of the terminal crisis.

Witness Wall Street for proof thereof. No trajectory of decline is in evidence, no terminal crisis is in sight.

The subversives are on their thrones and kinging the nation — to a very large extent at least.

Can they be unthroned? We conclude where we began… with Mr. Peter St. Onge:

The American financial system is “desperately ill,” kept alive only by an endless series of bailouts, like the ones that headed off bank failures last year… The only solution is forced recognition of bank losses — which would bankrupt them — then selling them to new management that will not have access to bailouts.

Yet is it feasible, sir?

The High Cost of Regret

Given their lobbying power, the odds of breaking up America’s megabanks are slim to none.

Meaning unless Washington reins in the banks, we’re in store for more existential financial crises, more bailouts and national debt and more running out the clock to financial catastrophe.

We missed our chance in 2008, and in all likelihood, it will take an even bigger crisis before politicians turn on their lobbyists and the financial coup that has seized our republic.

“Nothing is more expensive than regret,” someone, somewhere once said.

The United States may one day regret that it failed to put down the Quiet Coup in 2008 — in its adolescent phase.

It will likely prove a mighty expensive regret…

Comments: