Time to Take off the Bear Suit

Just a few weeks ago, I was writing to you about the ugly, maddening market conditions frustrating most investors.

While most stocks weren’t on the brink of serious breakdowns, there was a distinct lack of follow-through in most areas of the market. Rallies would appear, then fizzle before they could make any substantial headway. Only the mega-caps seemed to want to play nice with Apple Inc. (AAPL), Microsoft Inc. (MSFT) and just a few of their cohorts consistently marching higher.

Naturally, this action can cause traders to think bearish thoughts. After all, if stocks keep bumping into resistance and failing, maybe there simply aren’t enough buyers to get them over the hump.

Don’t get me wrong – prepping for downside action wasn’t the worst decision you could have made earlier this month. I was even making my own list of decent short opportunities, from sluggish small-caps to the teetering tech-growth names. It’s one thing to stay on top of the market. Leaning heavily short before witnessing any actual breakdowns is an entirely different story…

Remember: If the market doesn’t scare you out, it will wear you out.

As I’ve noted, there was nothing scary about the choppy market action. Most stocks weren’t breaking down — they were simply stuck in sideways ranges.

That’s what happens in choppy, potentially basing conditions: stocks grind away, wearing down the resolve of everyone whose mind is stuck replaying last year’s bear market. Investors get frustrated and sell. They give up on ever making back the losses. And they swear they’ll never again get sucked into another bubble.

Of course, this is precisely when stocks begin to bounce. The initial move is often violent, catching nearly everyone off guard. It can also push market leaders far into overbought territory.

This is where we find ourselves today. Market leading mega-cap tech and semiconductor stocks helped spark last week’s furious breakout, helping push the Nasdaq Composite to a gain of more than 3% on the week to close at new year-to-date highs.

While these gains from the tech space easily bested the S&P 500, the large-cap index was also able to post new year-to-date highs.

Now, the chase is on. Sold-out bulls are fighting to get back into the market after last week’s squeezy action. Instead of selling in May and going away for the summer, stocks are catching bids left and right. And we’re already seeing another broad rally to start the new trading week.

Unless this is the mother-of-all fakeouts, it’s time to take off the bear suit and plan your next move.

Here’s where I’m looking to find my next momentum trades…

Speculative tech plays catch-up

I’m already seeing some forgotten tech-growth names from the Covid Bubble catch higher following last week’s broad market breakout.

I already mentioned a few favorable earnings reactions we were seeing throughout this beaten-down group. Keep in mind, many of these names have been building wide bases for a year or more. The only thing missing has been upside breakouts.

That’s quickly changing.

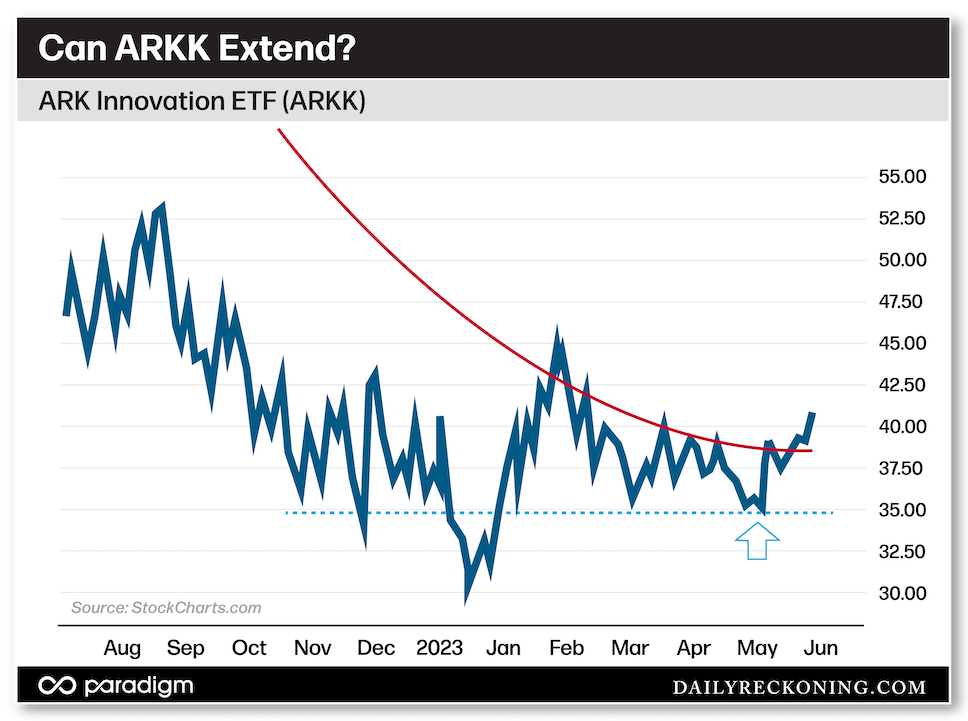

Just look at the action from Cathie Wood’s infamous ARK Innovation ETF (ARKK):

ARKK looked dead in the water at the beginning of May when it briefly lost the $35 level — which also marked the March lows. We discussed its multiple attempts to clear $40 and its 200-day moving average in late April as the ETF slumped last month.

But the $35 test held. ARKK has now started the new trading week with a bang, gaining nearly 5% on Monday to vault off its 200-day moving average following some constructive action last week.

This could be the first step toward ARKK regaining some of the momentum that pushed it off its lows back in January. We should remain on the lookout for those individual tech-growth stocks that are completing big bases for explosive moves higher.

Thinking smaller

Last week’s thrust higher placed many mega-cap tech names firmly in overbought territory.

While this is a positive development in the long-term, we should keep an eye on some rotation into other stocks and sectors as these leaders inevitably consolidate. If we are in the midst of a strong bull move into the summer, the tech giants will probably need to churn sideways while other groups take the baton.

We’ve already highlighted the explosive move in tech-growth to start the week. We should also monitor other beaten-down groups, such as regional banks (KRE) and small-caps (IWM) — both of which have greatly underperformed.

KRE has already rallied double-digits off its May lows. If smoother market conditions lie ahead, we could continue to see a sharp recovery in these names in the weeks ahead.

Waiting for Crypto

Stocks are firming up as Memorial Day approaches.

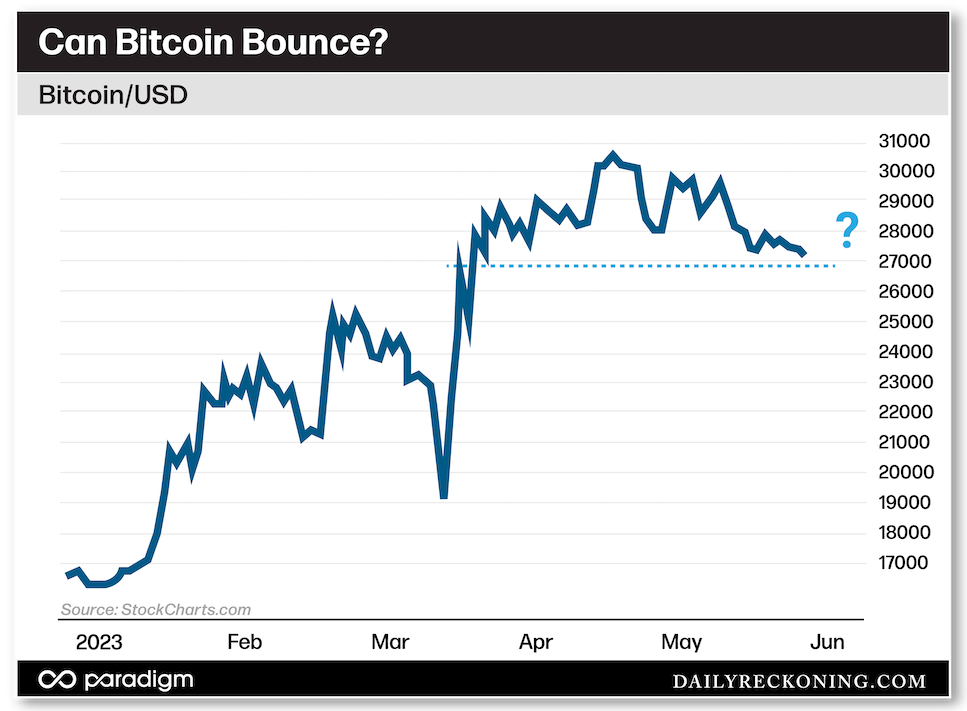

But what about Bitcoin?

We’ve discussed at length about how the crypto and speculative tech trades have been two sides of the same coin. But a divergence has been on full display since last week’s broad market rally. Stocks have stormed higher. But Bitcoin? It’s barely budged…

To be fair, Bitcoin has been able to cling to those late March consolidation lows just under $27K. But there’s been no positive momentum in the crypto space since that failed push above $30K last month.

The speculative tech stocks are already on the move. Is crypto next? Common sense says yes — as long as our correlations hold true.

I’ll be watching crypto — along with the crypto-related stocks — for a sharp move higher to materialize in the near future.

What do you think? What other potential rallies am I missing as the market firms up? Let me know by emailing me here.

Comments: