Banks Fold, Tech Holds

Investors are obsessed with this bear market.

Everyone wants to know when it will officially end and when they can go back to blindly buying stocks. They’re distracted by every possible piece of bearish news. Once-ignored economic numbers are now the focus of tedious news reports, leading to wild intraday price action as traders jockey for position.

Throw a fresh bank crisis in the mix, and we’re left with a choppy mess – and more than a few confused market watchers. Banks are failing. The financial news is more bearish than ever. Plus, we have to deal with the Fed this week… again.

While the market is currently expecting a 25 basis-point hike, investors will likely hang on Powell’s every word at tomorrow’s presser. They’ll grasp for any potential change in tone now that banks are on shaky ground.

Will Jerome release the doves? Or, will he hold the line?

Either way, the noise is just getting louder.

Yet despite the endless string of issues facing this market, you can still find positive developments bubbling up under the surface of the major averages.

You just have to know where to look…

In early March, we were fixated on several key do-or-die levels for stocks. Yes, there’s still plenty that needs to go right before we can sound the all clear and ride the averages back to their highs. But several beaten down groups are beginning to perk up while the S&P chops along in no-man’s land.

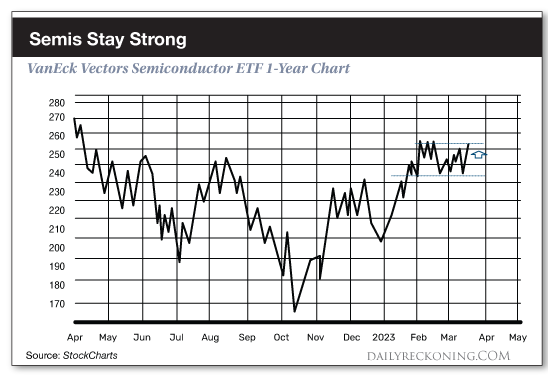

Streaking Semiconductors

The semis were dowside leaders in 2022. But we’ve discussed in detail how this important tech group snapped back to life in January. The VanEck Vectors Semiconductor ETF (SMH) jumped more than 20% to kick off 2023 in style. Where they go from here, we noted, would be incredibly important to the health of this market.

It just so happened that as many tech snapback tech names fizzled in February, SMH remained stubbornly strong. No, most semiconductor stocks did not streak higher in February or early March. But they didn’t give back a huge chunk of those January gains – unlike many other tech names that became a little too hot to kick off the year.

In fact, SMH posted the most constructive consolidation of the bunch. It was able to cling to those June and August 2022 pivot highs and set up another test of its year-to-date highs just above $250. That’s where it’s resting as I type.

While many tech subsectors – and the Nasdaq Composite, for that matter – endured sharper pullbacks last month, semis are staying constructive and attempting to lead us out of this mess.

We highlighted NVDA’s strong post-earnings performance as one of the key reasons SMH held steady during recent market weakness. Now, we can add another big name to the outperformer list as Advanced Micro Devices (AMD) broke out and streaked to new 7-month highs last week.

Strength is spreading through the semis. A clean breakout here could lead to the next leg of this powerful rally.

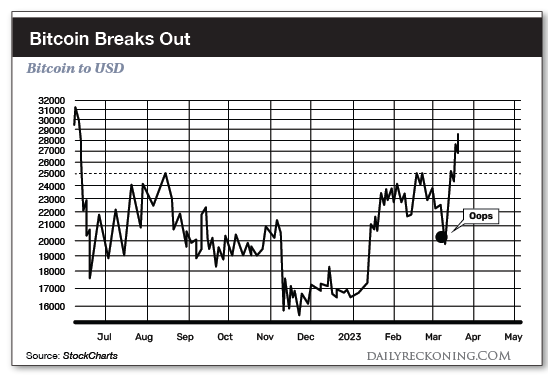

The Bitcoin Bulls are Back

Remember Bitcoin $25,000?

We’ve been sweating a $25K breakout ever since crypto began to consolidate its strong January rally. The idea is simple: If Bitcoin can hold a move above $25K, it would break free from its 2021-22 bear market and embark on a new uptrend.

But it’s never that easy – especially when it comes to crypto. Bitcoin looked coiled and ready to break higher in February. Then, it proceeded to tumble toward $20K before sharply reversing and posting its “official” breakout move. After surviving yet another crypto gut-check, Bitcoin has exploded higher, topping $28K for the first time since June 2022.

I’ve long argued that Bitcoin is a tech trade. If it walks like a tech stock and talks like a tech stock, it’s a tech stock! Crypto behaved exactly like the tech growth stocks during last year’s meltdown – and it rallied with them in January.

Now, something a little different is happening. Bitcoin is hitting nine-month highs, while tech growth names are still stuck in neutral following their sharp January rallies.

The Bitcoin faithful believe crypto is rallying because it’s a safe haven during the current bank turmoil. I’m not so sure. After all, this base breakout has been brewing since before we got the first whiff of Silicon Valley Bank going down in flames. Perhaps the recent turmoil is a good excuse for some buying here – but I don’t believe it’s the full story.

Even so, we should continue to watch this relationship develop to see if we truly get a decoupling. So far, Bitcoin has built a formidable lead, with the tech-growth stocks in Cathie Wood’s Ark Innovation ETF (ARKK) falling woefully behind over the past couple weeks.

Will Bitcoin drag its former bull market cousins back onto their feet? We’ll know soon enough.

In the meantime, the crypto-adjacent stocks are going streaking. Despite the noisy market backdrop, the Bitcoin adjacent names are blasting off along with the red-hot semis. If you’re searching for strong momentum plays that aren’t flinching during the ongoing bank drama, this is where you should begin your search.

Let me know what you thought of today’s article… and if you want any more topics covered by emailing me here.

Comments: