A Rant and a RIP For My Old Bank

Good Thursday morning to you!

I’ve been putting off writing about the demise of my old bank, Credit Suisse. I didn’t write about it in the Rude all week because I didn’t have the energy to do it justice.

But since this Morning Reckoning gives me a bit more latitude, I’ll tackle the subject here.

If you read the Rude, you know I spent over 11 years of my life over two stints working for Credit Suisse. And if you think that was a waste… I worked for Lehman Brothers for about 15 months before my first CS stint!

I’ve worked in CS’s Eleven Madison Avenue office in NYC, its 1-5 Cabot Square office in London, and its swanky 87-88th floor office in the ICC in Hong Kong.

In between my western and eastern stints, I got into financial training. It so happens I trained CS staff in Singapore, Hong Kong, Mumbai, Jaipur and Pune.

So I know the bank rather well. And other than friends losing their jobs, I’m not sad it’s gone.

In this piece, I’ll tell old stories, what CS’s problems really were and why banking regulation is ultimately useless.

Now let me share some of the amazing things that happened while I worked for them.

It Wasn’t All Bad

I didn’t realize how much I wrote about the good times in the Rude. I’ll link all those articles.

In short, my life never would’ve turned out this way without having worked at CS.

After all, not many workplaces second you from New York to London… and many years later, from Singapore to Hong Kong.

In New York, I never would’ve fallen in love with our impossibly beautiful 20-year-old intern – hold your horses, I was only 23 – and dated her for two years. Our first date is one for the ages, as you may read later.

While in London, Hung-Wah never would have driven me to Bruges for Belgian waffles.

I had forgotten my old boss, Ed, happily paid my tuition (out of CS’s pockets) for London Business School. Thanks Ed!

If I didn’t go to LBS, I never would’ve met Aussie Trav. That night we spent at the Duke of York pub in St. John’s Wood listening to a drunken head of risk management informs this very piece.

And I never would’ve got a bird’s eye view of the mortgage-backed securities debacle if I hadn’t met my girlfriend, who worked for S&P and explained everything to me.

Finally, I got to see the great proprietary trading desk of Alan Howard, Chris Rokos, et al, at work. They are still at it, at Alan’s Brevan Howard hedge fund and Chris’s family office.

If you read those pieces, you’ll know me very well.

Interestingly, the first column I ever wrote for the Rude, was titled “Credit Suisse Hwangs Itself; UBS Loses High Ground, Suffers $774m Loss.”

That explains quite a bit. And I’ll reference it here.

Senior Leadership

The problem was at the top of the house. In Zurich. Yes, Board-level idiocy.

Sure, you had some dummies in Asia and the Americas.

But the Swiss, themselves, were clueless as to how to run a global bulge bracket bank.

(I hasten to remind you – the Swiss government bailed out UBS itself in 2008.)

You’ll never see a more incompetent bunch of unjustifiably overconfident midwits in your lives.

As a CS employee, I can’t tell you the number of times I asked, “Who’s stupid f*cking idea was this?”

Most are already gone, thank the maker. As for the ones that remain, I hope each and every one of them gets fired. If they get to stay at the new UBS, it’s a crime.

But really, hiring Tidjane Thiam was the pièce de résistance.

Thiam was the CEO of the UK’s Prudential insurance company (not to be confused with The Rock in the US).

Despite coming from two rich West African families, speaking fluent French, English and German, clutching an Insead MBA and being a former McKinsey consultant, Thiam is a doofus.

His ass should’ve been thrown out of Prudential for a botched takeover of AIG’s Asian life insurer AIA.

But thanks to The Bernank’s helicopter money and the Bank of England trotting happily behind, sniffing Helicopter Ben’s ass, Prudential’s shares quadrupled under Thiam’s “leadership.”

This fooled the dopey Credit Suisse board, featuring “King of the Dipshits” Chairman Urs Rohner, into thinking hiring a black insurance CEO would goose CS’s share price.

And hire him they did.

At his first press conference, when asked if it would be different running an investment bank rather than an insurance company, the new CEO – and old McKinsey hand – said no, it’s just about numbers.

Soon after that presser, a Managing Director and I were walking up to the office. He looked at me and said, “I can’t believe Tidjane said that. Let’s see what the markets think.”

Needless to say, the markets weren’t impressed.

But the biggest mistake of Thiam’s reign was sidelining the sales and trading teams just as a new bull market began. It couldn’t have been a worse move.

Thiam wanted to copy UBS to create a wealth management powerhouse – not a bad idea – but one of CS’s great strengths was its traders and salesmen.

The investment bank thrived, mostly. The private bank did, too.

But during Thiam’s reign, the S&P 500 climbed over 62%. While Goldman Sachs, Morgan Stanley, Citi, and Bank of America raked it in on their trading floors, Credit Suisse barely participated.

This is Bastiat’s “Unseen” of why CS collapsed.

UBS Takes Over

I used to joke on LinkedIn, begging that UBS takeover CS to improve the look of my profile.

I thought it should’ve happened years ago, but the argument was always, “To what end?”

“Getting Credit Suisse’s Board away from the moving parts,” was a good enough answer for me.

Because ultimately, the Archegos and Greensill disasters happened because the C-Suite overruled the people on the ground.

Yes, risk managers told their bosses not to do these deals. But they were overruled because Thiam’s “entrepreneur’s bank” strategy of combining the private and investment banks colored their judgment.

That is, Bill Hwang’s private money was in the private bank and his hedge fund money was in the investment bank. If CS pissed him off, they lost twice. So they treaded lightly.

Far too lightly.

Costing a combined $6.78 billion, those two scandals destroyed Credit Suisse’s already barely existing credibility.

How CS lasted another two years is beyond me.

A Bailout at What Cost?

The Swiss National Bank (the Swiss central bank) backstopped UBS in a way US banks can only dream.

From The Wall Street Journal:

The complete write-down of Credit Suisse’s securities had been pushed for by UBS executives to reduce the burden the firm inherited by taking over its rival.

Some investors were caught off-guard because Credit Suisse common shares were spared, with UBS paying $3.2 billion for them via its own stock, even as the AT1s were written down.

While that upends the common order in an insolvency, there was a fierce debate over whether Credit Suisse AT1s in fact allowed such a move in their documentation.

Finma, the Swiss financial regulator, said Sunday that Credit Suisse was experiencing a crisis of confidence and risked becoming illiquid, even if it remained solvent, and required the state-engineered deal to stay alive. The government provided a more than $9 billion backstop to UBS on potential losses.

Sowing consternation among AT1 investors: Swiss authorities hastily passed a law last week that expedited the regulators’ ability to write down the riskier bonds to zero.

I’m running out of road here, but luckily I explained the AT1 capital situation in today’s Rude Awakening. Just click here and read it if you want to know more.

I’ll leave you with these shocking tweets:

Credit:@WallStreetSilv

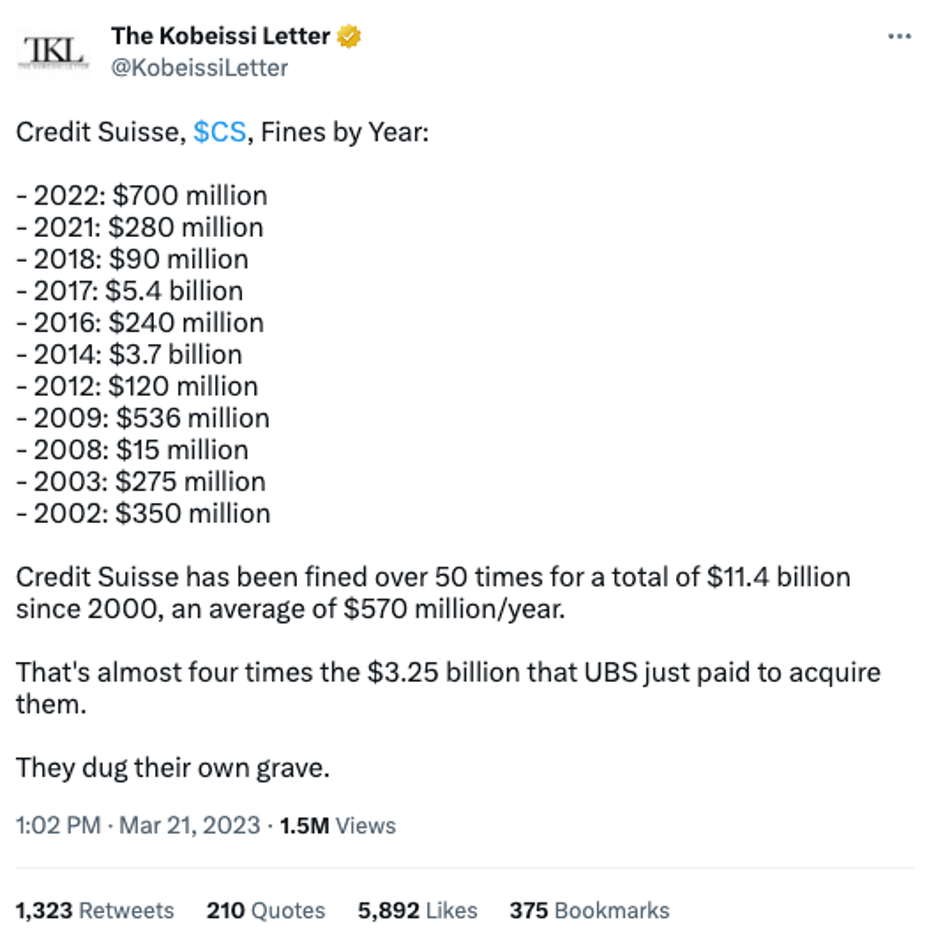

Credit:@KobeissiLetter

As Thomas Sowell once said, “In every disaster throughout American history, there always seems to be a man from Harvard in the middle of it.”

In this very Swiss disaster, in the middle of it was a guy from Insead.

RIP, Credit Suisse. Say hi to Lehman for me!

Let me know your thoughts by emailing me here, I really enjoy reading them!

Comments: