The Market’s Set to Be Trumped!

The market’s melt-up since the Feb. 11 interim low has been positively surreal. But there’s nothing sustainable about it.

This latest rebound was the work of eyes-wide-shut day traders and robo-machines surfing on a thinner and thinner cushion of momentum. What comes next, in fact, is exactly what happens when you stop pedaling your bicycle. Momentum gets exhausted, gravity takes over and the illusion of stability is painfully shattered.

The simple truth is, the Fed’s long-running interest rate repression policies have caused systematic, persistent and massive falsification of prices all along the yield curve and throughout all sectors of the financial market.

The Fed is just systematically juicing the gamblers, and thereby fueling ever greater mispricing of financial assets and ever more dangerous and explosive financial bubbles. What we’re seeing now is the illusion of stability.

During this year’s final pulse of the great stock market bubble of 2009–2016, the illusion of stability was reflected in the complete collapse of the VIX Index or, as it is often called, the fear gauge. It spiked above 18 briefly in mid-September… but it’s back down now.

Take a look at a chart from the last cycle, culminating in the crash of 2008:

The Greenspan housing, credit and stock market bubbles were inflating. At the same time, volatility was steadily drained out of the market by increasingly more bullish and complacent traders.

Accordingly, between the stock market’s bottom in September 2002 and the first hints of the subprime crisis in February 2007, the VIX Index dropped relentlessly. In fact, it was then down by 75% to a bottom index value of 10.2 on the eve of the mortgage crisis.

When the financial bubbles began to implode, however, the VIX exploded. By Oct. 28, 2008 it had risen by 550%. Traders who saw it coming and got long volatility, or “vol,” made a fortune.

It just so happens that recently, the VIX came close to its early 2007 low, touching 10.8 on an intraday basis. That meant that it had declined by 62% from its Feb. 11 level — and it had declined by 58% from its dramatic late-June spike at the time of the Brexit surprise.

In a word, by mid-August, the casino had become so complacent and fearless that you needed a motion detector to identify signs of life. At approximately noon on Aug. 16, in fact, the VIX Index literally did not move for upward of an hour.

Things were almost laughably quiet.

September was a bit of a roller-coaster month for market volatility. And as we enter the final months of the year, there are potential catalysts that could trigger an ever bigger spike in volatility before year-end. The election is a big one.

But the larger question is why a tiny bump in interest rates should even matter at all.

After seven years of zero or next to zero interest rates, it must be truly wondered how supposedly rational adults can obsess over whether the another tiny smidgen of a rate increase should be permitted this year or next, or whether the economy can tolerate a rise in the funds rate from 38 bps to 63 bps when it finally does move.

The difference is just irrelevant noise to the main street economy. It can’t possibly impact the economic calculus of a single household or business!

But then, again, the Fed doesn’t serve the main street economy. It lives to pleasure Wall Street.

Having pinned the money market rate at the zero bound for so long and with such an unending stream of ever-changing and silly excuses, the occupants of the Eccles Building are truly lost.

They do not even fathom that they are engaging in a word-splitting exercise no more meaningful to the main street economy than counting angels on the head of a pin.

Indeed, if they weren’t mesmerized by their own ritual incantation they would not presume for a moment that fractional changes of the money market rate away from ZIRP would have any impact on main street borrowing, spending, investing and growth.

So why does the Fed persist in this farcical minuet around ZIRP?

The principal reasons are not at all hard to discern. In the first instance, the Fed is caught in a time warp and fails to comprehend that the game of bicycling interest rates to heat and cool the macro-economy is over and done.

The credit channel of monetary transmission has fallen victim to “Peak Debt.” This means that the main street economy no longer gets a temporary pick-me-up from cheap interest rates because with tapped out balance sheets they have no further ability to borrow.

The only actual increases in household debt since the financial crisis has been for student loans, which are guaranteed by Uncle Sam’s balance sheet, and auto loans which are collateralized by over-valued vehicles.

Stated differently, home equity was tapped out last time and wage and salary incomes have been fully leveraged for years. So households have nothing else left to hock.

Accordingly, they now only spend what they earn, meaning that the Fed’s interest rate manipulations — which had potency 40 years ago — have no impact at all today. Keynesian monetary policy through the crude tool of money market rate pegging was always a one-time parlor trick.

Then why on earth do our monetary central planners cling so desperately to ZIRP?

The answer is they appear to believe that cheap money might still do a smidgen of good.

Besides, it hasn’t caused any consumer price inflation, or at least that’s what they contend — so where is the harm?

Well, yes. Doing a rain dance neither causes harm nor rain. Yet there is a huge difference. Zero interest rates are not even remotely harmless. They amount to a colossal economic battering ram because they transform capital markets into gambling casinos.

And the complacent casino is being set up for a fall when the battering ram hits.

The Fed is out of dry powder and out of time.

Now that Janet Yellen punted on a September hike, October will be 94 months crouched on the zero bound. By the Fed’s own faulty lights, it will have no excuse not to raise rates by 25 basis points in November or December. Especially if it continues to be deluded by the false and lagging indicators of the BLS jobs report.

But the market will sell off violently if the Fed goes ahead and raises rates. This has been recently suggested by its key rate strategist and Goldman man on the case, Bill Dudley, president of the New York Fed.

On the other hand, if it punts until another time, that decision will come with new concerns. Concerns that continuing headwinds from China, Europe and the rest of the world have the potential to seriously harm the struggling domestic recovery.

Even the day traders and robo-machines must know that the Fed is out of dry powder. It cannot go to subzero interest rates without triggering a Donald Trump-led domestic political conflagration. Nor can it abruptly shift to a huge new round of QE without confessing that $3.5 trillion of the same has been for naught.

In short, if it fails to raise rates and even hints at the risk of domestic recession, there will be pandemonium in the casino. The gamblers recognize that there will be no monetary fire brigade waiting at the exits.

Meanwhile, if the Fed raises rates in December, we could face the day of reckoning. This time, I believe that the Fed’s desperate last resort to verbal intervention will fail, causing a market now living off the fumes of momentum to hit the skids.

In the short-term, an improved Trump showing at the next debate could trigger volatility as well. I was disappointed in his first performance. The results of this debate could rattle the market because at the moment Hillary Clinton is considered to be a shoo-in.

I beg to differ and have some personal experience with respect to what might be an October surprise.

Back in 1980 I was actually Ronald Reagan’s sparring partner in his Jimmy Carter debate rehearsals. I saw what can happen when a candidate finally gets the pulse of the country and scores big in the Presidential debates.

Reagan did that and came from way behind to win. There is no telling how Donald Trump will do next time, but at this stage of the game there is absolutely no reason to think that the market has it right and that Hillary has it in the bag.

But don’t get too comfortable. This market is just waiting to get Trumped!

Regards,

David Stockman

for The Daily Reckoning

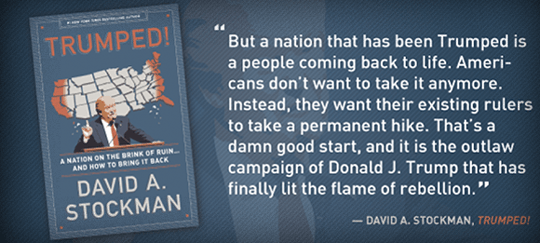

P.S.TRUMPED! is “the right book at the right time,” according to Jim Rickards. “The brilliant David Stockman sets the stage for the next four years…” I’ve gone ahead and reserved a free autographed copy of my book for you. Click right here to learn how to claim it. Inside, you’ll learn…

Click here to fill out your address and contact info. If you accept the terms, the book will arrive at your doorstep in just a few weeks. |

Comments: