Real Money and Why You Need It Now

Many years ago, before the invention of modern money or capitalism, people still had wealth – although limited. And they still had ways of keeping track of it. The principle of “fair trade” seems to be in our DNA.

If you give something to your neighbor, you don’t expect him to hit you over the head. You expect him to give you something back. And if you give him a whole cow and he gives you half of a rabbit, some instinct tells you it isn’t “fair.”

Small communities could keep track of who owed what to whom. But as civilization evolved, a new kind of money was needed.

In a group of related people in an isolated valley, you could remember that your cousin should give you something roughly equal in value to the wild pig you gave him… and that you should offer your son or daughter to the family from which you had gotten your wife… and so on.

But as the group grew bigger, people needed a way to settle transactions without having to trust the people they were doing business with or remember who owed what to whom.

When Aristotle described “money” he had our modern money in mind – something that is not wealth but acts as a placeholder for wealth. It is information; it tells you how much real wealth you can command.

For the last 5,000 years, the best money has been gold (and to a lesser extent, silver). Gold is very useful as money. With it, you can do business with complete strangers. It can be used to stand in for almost any amount of wealth. Later, paper money – representing units of gold or silver – made commerce even easier. Without this modern money, an advanced economy wouldn’t be possible.

Real money permits an elaboration of the division of labor, and it provides the whole system with the information it needs to operate. You can’t build an automobile, for example, without an extensive network of inputs – labor, steel, batteries, glass, rubber – from all over the world.

And to put them together in any sensible way, you need to know what each of them costs. Getting your rubber from Malaysia will be a lot more efficient than trying to get it from Finnish suppliers; the price, expressed in units of money, will tell you that immediately.

That’s one reason high levels of inflation bring an economy to a halt. The placeholder loses its place. You just don’t know what anything costs. And from one minute to the next, your place in line changes.

Another important feature of modern money is that transactions are final. I give you a chicken… you give me a small gold coin. Done deal. I don’t have to worry about what happens to you in the future. I’ve got my coin. I have no further claim against you. You’ve got no claim against me.

Yes, there is always a chance that gold might lose value… that it might not hold its place in line very well. It is not a great concern, though.

Prices go up and down. But according to The Golden Constant by Roy William Jastram, the value of gold today is about the same as it was – to the extent these things can be measured accurately – 500 years ago. And I don’t have to worry about a third party because there’s no third party, or counterparty, in the deal.

Gold is a “trustless” money. We don’t have to trust the guy we got it from. And it wasn’t issued or created by some government agency, so we don’t have to trust the feds to maintain its value.

When the U.S. money system was changed in two moves – first when Lyndon Johnson asked Congress in 1968 to repeal the requirement for a gold reserve to back U.S. currency and second when Richard Nixon ended dollar convertibility to gold in 1971 – the U.S. government reintroduced a more primitive form of money. It also introduced a queer wrinkle.

With this new money, the U.S. economy – and, by extension, much of the world economy – has been shaped by credit above and beyond available savings. Trillions of dollars’ worth of new hotels, houses, companies, malls, factories, dinners, drugs – and just about everything else – have been financed with this empty credit.

Sooner or later, this debt must be reckoned with – either in deflation… or in inflation. But someone pays. With deflation, the creditor pays when his credit goes bad. With inflation, everyone pays as prices rise.

So far, since 1971, the typical American’s trust in the dollar has been rewarded with a huge loss – about 95% of the dollar’s 1971 value has disappeared. As you would expect. This new money is no longer trustless. Every transaction involves a third party – the custodian of the currency.

Say you build a business and sell it for $1 million. You know that you can exchange that money for a million dollars’ worth of goods and services. The money represents a million dollars’ worth of resources. It came from something with tangible value that was added to the economy.

But if that million dollars was lent into existence by the bank or printed into existence by the central bank, rather than honestly earned and saved, there would be no corresponding addition to the world’s supply of goods and services.

This is just another way to look at the classic quantity theory of money. The supply of goods and services always has to be balanced against the available money. If the amount of available money (or credit) doubles and the supply of goods and services remains unchanged, prices should double, too. Not immediately. But often suddenly.

Gold is distinct in that it cannot be mined easily. The costs of mining tend to increase with GDP and general price levels. So the supply of this type of money tends to rise more or less in line with the supply of goods and services.

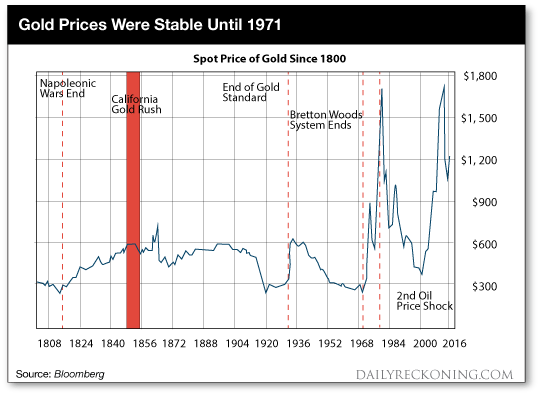

Prices remain roughly stable. There is no custodian you have to worry about. It is a trustless currency. You can see above how gold’s dollar price remained fairly stable until the new money system was put into place in 1971.

Since the custodian – the third party – came into the deal, the value of the greenback has fallen from $40 per ounce of gold to $1,200 per ounce.

This is something to worry about, especially as debt levels are reaching new records and the custodian’s commitment to maintain the value of the dollar is demonstrably weak. The feds actually want a weaker dollar and don’t hesitate to say so.

But at least that threat is understood, if not fully appreciated. It is “textbook.” Add to the supply of money and, other things being equal, you will raise prices. You will not increase wealth levels nor GDP; you are only changing the relation of available goods and services to the available money.

Also textbook is this: In an ideal, honest money system, you cannot lend money you don’t have. You couldn’t lend out gold unless you had gold to lend. No lending in excess of available savings = no artificial increase in the money supply = no price inflation (neither in assets nor in consumer goods and services). No artificial boom = no consequent bust.

So, you see, there are obvious benefits to gold if you want to run an honest money system. And while the pre-1971 money system did not meet this ideal, the dramatic unreliability of the post-1971 money is well demonstrated in the chart above. Its dishonesty is illustrated by the amount of credit created since it began – about $59 trillion worth.

This is textbook, too. This is credit in excess of available real savings. It is a fraud, and it produces fraudulent, unsustainable growth.

Regards,

Bill Bonner

for The Daily Reckoning

Comments: